The Cost of Veterinary Care: Planning and Budgeting

Understanding the Variables Affecting Veterinary Costs

Predicting veterinary costs for animals, particularly in the long term, requires a comprehensive understanding of the factors influencing these expenses. These factors are multifaceted and often intertwined, making accurate forecasting a complex process. Initial consultations, diagnostic tests, medication, and potential surgical procedures all contribute to the overall cost, and their prices can vary significantly depending on location, the specific veterinary practice, and the animal's breed and condition. Understanding these variables is the first step towards developing a realistic and informed financial plan for pet owners.

Beyond initial care, ongoing preventative care, like vaccinations and regular checkups, also contribute to the long-term veterinary costs. Accurately anticipating these ongoing expenses is crucial for long-term financial planning. The frequency and cost of these procedures will vary based on the animal's age, breed, and any pre-existing conditions. Therefore, a thorough understanding of the animal's unique needs is important for establishing a budget that encompasses both immediate and future requirements.

Estimating Costs Based on Animal Health Conditions

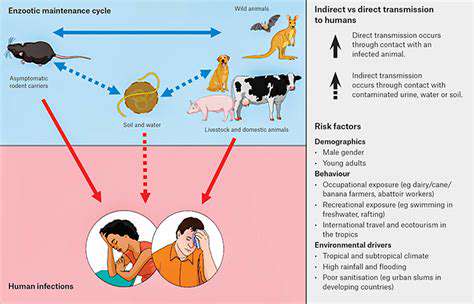

Predicting veterinary costs is significantly impacted by the animal's overall health. Chronic conditions, such as arthritis or diabetes, often require ongoing medication and frequent checkups, leading to substantial long-term expenses. Accurately assessing the potential for developing health issues and factoring these costs into the forecast is essential. Understanding the likelihood of these conditions and the associated costs is critical for responsible financial planning.

Acute illnesses or injuries can also create unexpected costs. These can include emergency care, hospitalization, and specialized treatments. The severity of these events, and the time required for recovery, can significantly impact the overall cost. It's important to recognize that these costs can vary greatly depending on the nature and severity of the injury or illness. This unpredictability highlights the importance of having a financial cushion set aside for unexpected veterinary expenses.

Analyzing Veterinary Practice and Location Factors

The cost of veterinary care varies significantly between different veterinary practices and geographic locations. Some practices may have higher overhead costs or specialized equipment, which can translate into increased fees for services. Location plays a significant role, with costs often being higher in urban areas or regions with a higher cost of living. Understanding these variables and comparing costs across different practices is crucial for pet owners seeking the most cost-effective care.

The availability of specialized veterinary services, such as those for exotic animals or certain surgical procedures, can also influence costs. Regions with limited access to specialized care may lead to higher expenses due to the need for transportation or referral to other facilities. Evaluating these factors will enhance the predictive accuracy when determining veterinary costs.

Developing a Realistic Budget for Veterinary Care

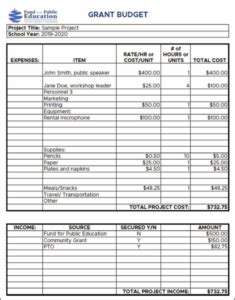

Creating a realistic budget for veterinary care requires careful consideration of the animal's specific needs, the potential for unexpected events, and the cost variations across different practices and locations. A comprehensive budget will ensure that pet owners are prepared financially for the costs associated with their animal's health and well-being. This plan should include an emergency fund to cover unexpected situations and long-term care expenses for chronic health conditions.

Creating a Realistic Veterinary Budget: Itemizing Costs

Creating a Realistic Veterinary Business Plan

A robust veterinary business plan is crucial for success in the competitive animal healthcare market. It's not just a document; it's a roadmap that guides your decisions, attracts investors (if needed), and helps you stay focused on your goals. A well-defined plan outlines your target market, services offered, financial projections, and operational strategies, ultimately increasing your chances of profitability and long-term sustainability. It provides a solid foundation for navigating the challenges and uncertainties inherent in the veterinary industry.

Market Analysis and Target Audience

Thorough market research is paramount. Identify the demographics of the area you're serving, analyzing factors like pet ownership rates, types of pets, and the presence of competitors. Understanding your target audience—are you catering to companion animals, livestock, or both?—is crucial for tailoring your services and marketing strategies effectively. This research will allow you to position your veterinary clinic to best meet the needs of your specific community.

Services Offered and Operational Structure

Clearly define the range of services you'll provide. Will you focus on general practice, or specialize in areas like surgery, dentistry, or internal medicine? Detailing your operational structure, including staffing needs (veterinarians, technicians, receptionists), appointment scheduling, and facility layout, is vital for efficient service delivery. A well-organized operation translates to happy clients and a smooth workflow.

Financial Projections and Budgeting

Detailed financial projections are essential. Estimate startup costs, operating expenses, projected revenue, and profit margins. Accurately forecasting these elements allows for informed decision-making and helps you secure funding if necessary. Understanding your financial position is crucial for making strategic choices. This includes anticipating potential challenges and developing contingency plans.

Marketing and Client Acquisition Strategies

Develop a comprehensive marketing plan to attract and retain clients. Consider strategies like online presence (website, social media), local advertising, community involvement, and referral programs. Crafting a compelling brand identity that resonates with your target market is paramount for establishing a recognizable and trusted presence. Effective marketing will not only bring in new clients but also foster loyalty and build a strong reputation.

Legal and Regulatory Compliance

Adhering to all relevant legal and regulatory requirements is non-negotiable. Ensure your clinic complies with local, state, and federal regulations concerning licensing, permits, and safety protocols. This includes complying with health and safety standards, and ensuring all employees are properly trained and certified. This is paramount to maintaining a legally sound and ethically responsible veterinary practice.

Contingency Planning and Risk Management

Develop contingency plans to address potential challenges, such as unexpected equipment failures, staff shortages, or economic downturns. Proactively identify potential risks and mitigate them with appropriate strategies. Having a plan in place for unforeseen events minimizes disruptions and ensures business continuity. A proactive approach to risk management is essential for navigating the unpredictable nature of the veterinary business and ensuring long-term success.

Beyond the Basics: Special Needs and Senior Pets

Understanding Special Needs

Caring for senior pets or pets with special needs often necessitates a significant investment in veterinary care. These animals may require specialized diets, ongoing medication management, and more frequent checkups. Predicting and budgeting for these additional expenses is crucial for pet owners to ensure their companions receive the best possible care throughout their lives. Planning ahead financially can help prevent unexpected veterinary bills from overwhelming a budget.

Understanding the potential for chronic conditions, such as arthritis or diabetes, is essential. Regular vet visits for early detection and management are often more cost-effective in the long run than addressing severe complications later. Being prepared for these potential needs is an integral part of responsible pet ownership.

Senior Pet Care Considerations

As pets age, their needs evolve. Senior pets often require more frequent veterinary checkups, potentially including blood work, X-rays, and other diagnostic tests. Medication for age-related conditions, such as joint pain or cognitive decline, can also add to the overall cost of care. Budgeting for these needs in advance is vital to maintain the high quality of life for senior pets.

Senior pets may also have increased needs for specialized nutrition and care. Senior pet food formulations are often designed to support the unique nutritional requirements of aging animals. This specialized care can come with a higher price tag, but it is frequently crucial to maintaining their overall well-being.

Specialized Veterinary Services

Beyond routine checkups, senior pets or those with special needs may require specialized veterinary services. These services can include physical therapy, rehabilitation, or even surgery for conditions like hip dysplasia or other age-related issues. It's crucial to understand that these specialized services often come with a higher price tag than routine care.

Addressing Chronic Conditions

Managing chronic conditions in pets, such as kidney disease, heart disease, or cancer, can significantly impact the cost of veterinary care. Ongoing medication, specialized diets, and frequent monitoring can quickly add up, potentially creating a substantial financial burden. Proactive planning and open communication with your veterinarian about potential costs associated with these conditions are paramount for responsible pet ownership.

Long-Term Care Planning

Long-term care planning for pets with special needs or senior pets is crucial for financial preparedness. Anticipating potential costs associated with ongoing treatment, medication, and specialized care allows pet owners to create a budget that can accommodate these expenses. Having a clear understanding of these costs can help prevent financial strain and ensure your beloved companion receives the best possible medical attention throughout their life.

Regular Savings: Building a Veterinary Emergency Fund

Understanding the Unexpected

Unexpected veterinary emergencies can arise at any time, and the cost can quickly escalate. A sick pet requiring hospitalization, surgery for an injury, or treatment for a chronic condition can easily drain savings and create significant financial stress. Preparing for these eventualities is crucial for pet owners, and a dedicated emergency fund can provide peace of mind during challenging times.

Accidents and illnesses are unpredictable, but they happen. Having a financial cushion in place can help you navigate these situations without compromising your pet's care or your own financial stability. This proactive approach reduces the pressure and allows you to focus on what matters most – your pet's well-being.

Establishing a Realistic Budget

To build a robust veterinary emergency fund, you need a clear understanding of your pet's potential healthcare needs. Consider the average cost of routine checkups, vaccinations, and preventative care. Then, factor in potential emergencies, such as emergency room visits, surgeries, or ongoing treatments for chronic conditions. Research typical costs in your area for these services to get a realistic estimate.

Create a detailed budget that accounts for all veterinary expenses. Track your pet's current healthcare spending to identify potential gaps and areas where you can cut costs. This will allow you to set realistic savings goals and create a plan to achieve them.

Creating a Savings Plan

Decide on a specific amount you want to save for your veterinary emergency fund. Even small contributions each month can add up over time. Set up automatic transfers to a separate savings account to make saving effortless. This consistent saving habit will help you reach your goal faster.

Consider different savings strategies, such as high-yield savings accounts or certificates of deposit (CDs). These options can earn interest, allowing your savings to grow over time. Research various financial options to find one that best suits your needs and financial goals.

Automating Your Savings

Setting up automatic transfers from your checking account to your veterinary emergency fund account is a crucial step to ensure consistent saving. This automatic process eliminates the need for remembering to make manual contributions, fostering a consistent saving habit. Even small, regular contributions can significantly impact your savings over time.

This automation strategy prevents procrastination and ensures that savings consistently accumulate. You'll be surprised how quickly your savings grow when you make this a regular part of your financial routine.

Exploring Additional Support Options

Explore options for veterinary care financing, such as payment plans or credit cards with pet insurance benefits. Understand the terms and conditions of these options to ensure they align with your budget and financial capabilities. These resources can help alleviate the financial burden of unexpected veterinary expenses.

Regular Reviews and Adjustments

Regularly review your veterinary emergency fund and adjust your savings plan as needed. Assess your pet's health and any changes in costs for veterinary services. Also, consider any changes in your financial situation that might impact your ability to save. A flexible approach allows you to adapt to unforeseen circumstances.

Review your savings periodically to ensure you're on track to meet your goals. Adjust your contributions or strategies as needed to maintain a healthy balance between your financial priorities and your pet's care.

Read more about The Cost of Veterinary Care: Planning and Budgeting

Hot Recommendations

- Holistic Pet Health: Integrating Approaches

- The Future of Pet Identification: Biometric Scanners

- Service Dogs for PTSD: A Guide to Support

- The Benefits of Non Anesthetic Professional Teeth Cleaning

- Herbal Supplements for Pet Joint Health

- The Intersection of IoT and Pet Wellness

- Healthy Weight Management for Senior Pets

- The Best Pet Beds for Orthopedic Support and Comfort

- Competitive Dog Sports: Agility, Flyball, Dock Diving

- Luxury Pet Hotels: Pampering Your Beloved Pet