The Cost of Vet Care: Budgeting and Planning

Creating a Realistic Veterinary Budget

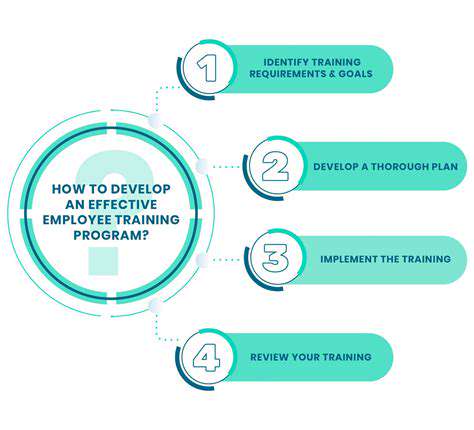

Creating a Realistic Veterinary Business Plan

A robust veterinary business plan is crucial for securing funding, attracting clients, and ensuring the long-term success of your practice. It should outline your vision, mission, target market, and financial projections. Thorough market research is essential to understanding the needs and preferences of potential clients in your area. This research will help you tailor your services and marketing strategies accordingly, maximizing your chances for a thriving practice.

Defining Your Niche and Services

Consider specializing in a particular area of veterinary medicine, such as exotic animals, senior care, or preventative medicine. This niche approach can help you stand out from the competition and attract a loyal clientele. Clearly define the services you will offer, ensuring they align with your expertise and the needs of your target market. This focus allows you to build a strong reputation and attract the right clientele.

Developing a Comprehensive Marketing Strategy

Effective marketing is key to attracting new clients and building brand awareness. Utilize various channels, including online advertising, social media marketing, local partnerships, and community outreach events. Consider strategies like creating a user-friendly website and engaging content to attract potential clients. This will help you establish a strong online presence and demonstrate your commitment to providing top-tier veterinary care.

Estimating Start-up Costs and Funding Sources

Thoroughly research and estimate all start-up costs, including equipment, licensing fees, staff salaries, and initial marketing expenses. Explore various funding options, such as personal savings, loans, or grants. A realistic financial projection is critical for long-term sustainability and should include all potential expenses. This will help you make informed decisions about your financial resources and ensure you are prepared for the financial demands of running a veterinary practice.

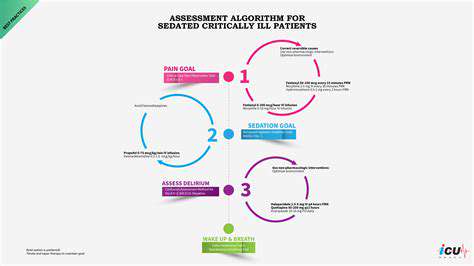

Establishing Operational Procedures and Policies

Develop clear and comprehensive operational procedures for managing appointments, billing, inventory, and client communication. Establishing clear policies on patient care, emergency procedures, and staff responsibilities is essential for smooth operations. These procedures will ensure consistency and efficiency, especially during peak hours or urgent situations.

Building a Strong Team and Managing Staff

Recruiting and retaining qualified and compassionate veterinary professionals is crucial for providing excellent patient care. Develop a comprehensive employee handbook outlining expectations, compensation, and benefits. Building a positive and supportive work environment is essential for attracting and retaining high-quality veterinary staff. This will help you create a team focused on providing exceptional care for your clients and their furry friends.

Legal and Regulatory Compliance

Ensure your practice complies with all relevant state and local regulations regarding veterinary practices. This includes obtaining necessary licenses and permits, adhering to animal welfare standards, and ensuring proper record-keeping. Understanding and adhering to these regulations is essential for avoiding legal issues and maintaining a reputable practice. This will help build trust with both clients and regulatory bodies.

Seeking Financial Assistance and Resources

Understanding Financial Assistance Programs

Navigating the world of financial assistance programs can feel overwhelming, but understanding the available options is crucial for anyone facing financial hardship. These programs often provide crucial support, whether it's for emergency situations or long-term financial stability. Knowing the different types of programs and eligibility requirements is the first step to accessing the resources you need.

There are many different programs available, including those focused on specific needs like housing assistance, food security, or educational funding. Researching and understanding these programs can help you identify the ones that best suit your situation and maximize your chances of receiving aid.

Eligibility Criteria and Application Process

Eligibility criteria for financial assistance programs vary significantly depending on the program and the specific needs it addresses. Frequently, factors like income level, family size, and specific circumstances are considered. Applicants should carefully review the specific requirements of each program they're interested in to ensure they meet the necessary criteria.

The application process often involves submitting documentation to verify your information and demonstrate your need for assistance. This might include income statements, proof of residency, or other relevant supporting documents. Thorough preparation and accurate submission are essential for a successful application.

Types of Financial Assistance

Financial assistance programs encompass a wide range of support, from emergency grants to ongoing subsidies. Examples include unemployment benefits, housing assistance programs, and food assistance initiatives. Understanding the different types of programs is essential to finding the most suitable option for your specific financial needs.

Some programs offer direct financial aid, while others provide access to resources and services that can improve financial well-being, such as job training or financial literacy courses.

Accessing Relevant Resources

Identifying and accessing relevant resources is crucial in seeking financial assistance. This involves researching programs offered by local, state, and federal government agencies, as well as non-profit organizations. Reliable information sources are essential to avoid scams and ensure you are working with legitimate organizations.

Online databases and government websites can be valuable tools for locating financial assistance programs. Making use of these resources can save time and effort in your search for appropriate support.

Importance of Timely Application

Many financial assistance programs have specific deadlines for applications. Missing these deadlines can result in your application being rejected. Therefore, it's important to be aware of these deadlines and submit your application in a timely manner. Planning ahead and scheduling your application process is crucial to avoid potential delays. Understanding the urgency of timely application is important.

Seeking Professional Guidance

Navigating the complexities of financial assistance programs can be challenging. Seeking professional guidance from a financial advisor or a non-profit organization specializing in financial assistance can be invaluable. These professionals can provide personalized advice and support throughout the application process.

Maintaining Open Communication

Maintaining open communication with the financial assistance provider is vital. This includes keeping them updated on any changes in your circumstances. Keeping the lines of communication open ensures that you receive the appropriate support and that the assistance is tailored to your evolving needs.

Read more about The Cost of Vet Care: Budgeting and Planning

Hot Recommendations

- Holistic Pet Health: Integrating Approaches

- The Future of Pet Identification: Biometric Scanners

- Service Dogs for PTSD: A Guide to Support

- The Benefits of Non Anesthetic Professional Teeth Cleaning

- Herbal Supplements for Pet Joint Health

- The Intersection of IoT and Pet Wellness

- Healthy Weight Management for Senior Pets

- The Best Pet Beds for Orthopedic Support and Comfort

- Competitive Dog Sports: Agility, Flyball, Dock Diving

- Luxury Pet Hotels: Pampering Your Beloved Pet